Disclaimer: Trading involves significant risk of loss and is not suitable for all investors. The strategies discussed here are for informational purposes only and do not guarantee profits or protection against losses. Past performance is not indicative of future results. Investors are advised to consider their financial situation, objectives, and risk tolerance before trading.

Effective trading often involves managing losses to enhance potential profitability.

And that’s why in Galileo FX we created 5 different ways to limit trading losses.

Remember, net profits are calculated by subtracting losses from gross profits, highlighting the importance of managing losses:

NET PROFITS = GROSS PROFITS - LOSSES

Watch the video below for an overview of how you might manage losses using Galileo FX.

If you want to succeed in trading, you need to be clever and limit losses as much as possible.

Here are 5 ways to limit trading losses in Galileo FX.

You can easily use these 5 settings together to minimize losses.

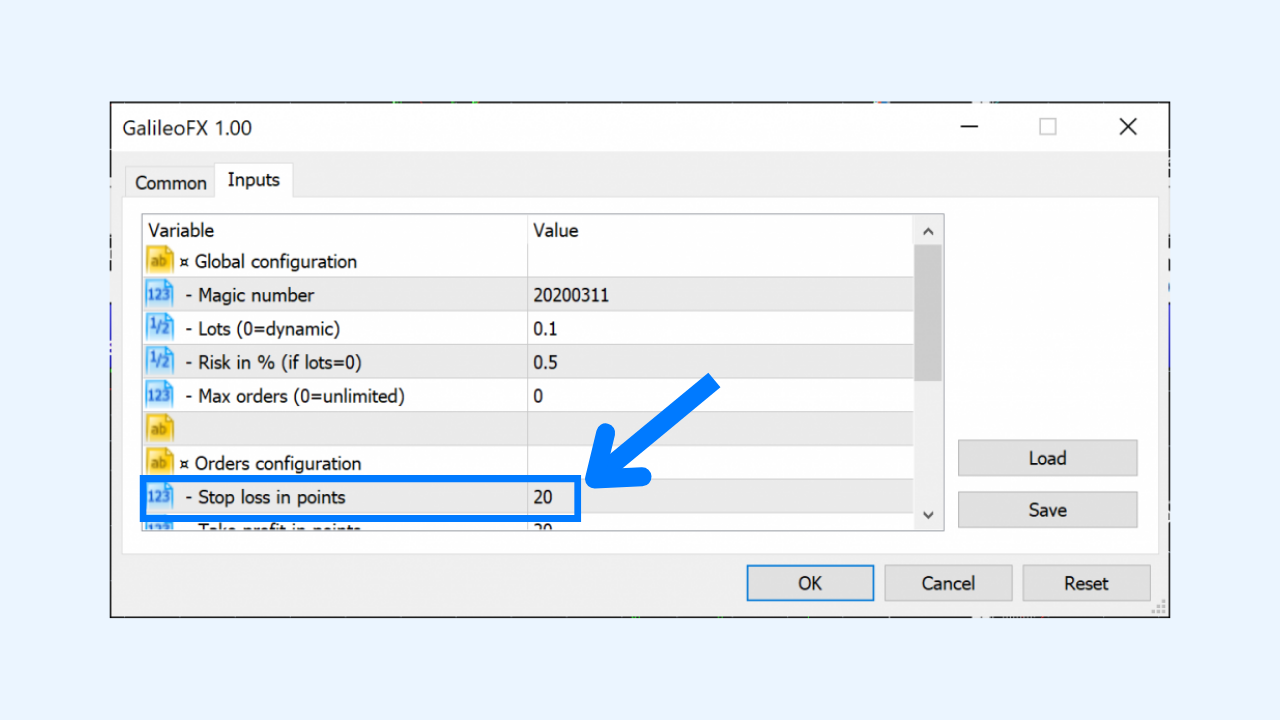

1. Stop Loss setting

The Stop Loss setting is a widely recognized tool that can help manage risk. However, its effectiveness can vary based on market conditions and individual trading strategies.

In Galileo FX, it's easy to set a Stop Loss.

When you set a Stop Loss in Galileo FX, the stop loss is applied to every trade opened by the trading robot.

Proper use of the Stop Loss setting can be crucial, though it's important to note that it does not eliminate the risk of losing money.

Although some traders may achieve high profits without a Stop Loss, incorporating this setting could be considered as part of a broader risk management strategy.

TIP: Use Stop Loss to limit losses to a specific value for every trade opened by Galileo FX.

2. Max Orders setting

The Max Orders setting allows you to set a limit on the number of trades that Galileo FX can execute. This can help in managing exposure, though it doesn't eliminate the inherent risks of trading.

Using Max Orders is especially useful if you want to make sure that Galileo FX will not open more than one order.

For example, setting Max Orders to 1 for EUR/USD means only one trade will be opened until you decide to adjust this setting. This method helps control trading activity but does not assure avoidance of losses.

TIP: Use Max Orders to limit the number of orders opened by Galileo FX on a specific chart (for example, EUR/USD).

3. Consecutive Signals settings

In Galileo FX, you have the option to set the number of consecutive signals required before executing a buy or sell order. This can potentially help in reducing premature or risky trades.

Different values, ranging from 0 to 10, can be set for both Bullish and Bearish Consecutive Signals, offering flexibility in your trading strategy.

This setting is designed to assist in managing risk, though like all strategies, it cannot completely prevent losses.

Setting higher values for Consecutive Signals can decrease the likelihood of frequent trades, potentially reducing risk exposure but may also limit potential profits.

For more detailed information about risk management with Consecutive Signals, please refer to the Settings page.

TIP: Use Consecutive Signals between 8 and 10 to limit the risk of entering high-risk/high-reward trades.

4. Lot Size setting

5. Trailing Start & Step settings

The 'Trailing Start & Step' settings are advanced options suitable for experienced traders or those looking to experiment with their trading strategies. The Trailing Step, a key component of Trailing Stop orders, adjusts as your position moves favorably, securing profits by following the price movement and automatically closing if the market trends unfavorably. It's crucial to note that while this feature can help secure profits and limit losses, it does not ensure immunity from market risks.

A Trailing Step is a measure of price movement and a key component of a Trailing Stop order – a type of stop-loss order that follows your position if it earns you profit and closes if the market moves against you.

In Galileo FX, you can set the value of a Trailing Step in points. Proper utilization of this setting requires understanding of both its mechanics and market behavior to effectively use it as part of your risk management strategy.

For more information, please check: Galileo FX Tutorial: How to Install & Use the Trading Bot